is an inheritance taxable in michigan

Mom had opted to have. Michigan Estate Tax.

Although Michigan does not impose a separate inheritance or estate tax on heirs you may have to pay state taxes on your annuity income.

. If you indicate which state you. Is there still an Inheritance Tax. Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who.

You may call 517 636-4330 for additional information regarding the inheritance tax act. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where. However the state in which you reside may have an inheritance tax if you live in a state other than MI.

I will be splitting it with my sisters. There is only one thing you need to know about Michigan estate taxes on an inheritance. An inheritance tax is a tool that governments sometimes use to tax assets that people get as part of an inheritance.

Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today. Ad Inheritance and Estate Planning Guidance With Simple Pricing. While the Michigan Inheritance Tax no longer exists you may be subject to the Michigan Inheritance Tax if you inherited an asset from an estate prior to 1993.

An inheritance tax is a tax on the right to receive property by inheritance. Is An Inheritance Taxable In Michigan. Mom recently passed and left an IRA with me listed as beneficiary.

Inheritances that fall below these exemption amounts arent subject to the tax. Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019. In short it depends on whether the sale counts as a gain or a loss.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from. There is no federal inheritance tax but there is a federal estate tax. Thursday February 20th 2020 407 pm.

Michigans income tax rate is a flat 425 and local income taxes range from 0 to 24. Died on or before September 30 1993. An inheritance tax a capital gains tax and an estate tax.

How much or if youll pay. Thats because Michigans estate tax depended on a provision in the Internal Revenue Tax Code allowing a state estate. Michigan does not have an inheritance tax with one notable exception.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state. Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it. What is Michigan tax on an inherited IRA.

According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of. Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income. However inheritance is only taxable in six states - Iowa Kentucky Maryland Nebraska NJ and Pennsylvania - and exemptions apply.

I will be splitting it with my sisters. Michigan does not have its own Estate Tax however your estate may be subject to Federal Estate Taxes depending on its size. The Michigan inheritance tax was eliminated in 1993.

Michigan does not have an inheritance tax. Its applied to an estate if the deceased passed on or before Sept. As of December 31 2004 there is no death or estate tax for.

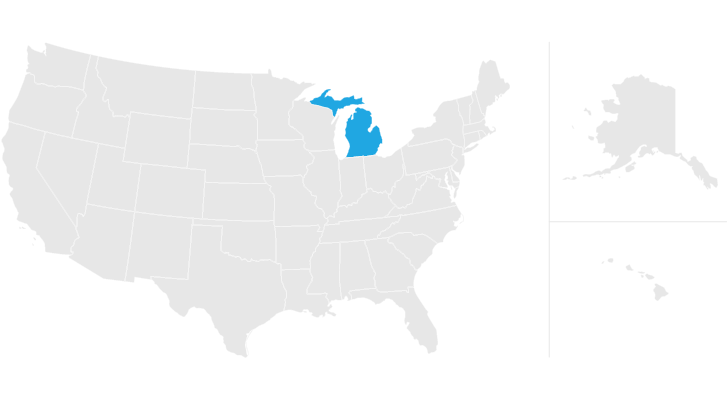

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. Like the majority of states Michigan does not have an inheritance tax. As you can imagine this tax can have a big impact when.

That means that if your. However if the inheritance is considered income in. The short answer is yes.

Michigan does not have an inheritance or estate tax but your estate will be subject to the Wolverine States inheritance. An inheritance tax is a levy. The Michigan inheritance tax was eliminated in 1993.

Michigan does not have an inheritance tax.

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Inheritance Laws What You Should Know Smartasset

Frugal Retirees Ditch 4 Percent Rule Hoard Savings Instead Frugal Hoarding Retirement

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Xl Property Management Llc Property Management Management Management Company

Services Tax Return Filing Consultants Tax Services Tax Preparation Services Accounting Services

Examples Of Expansionary Monetary Policies Monetary Policy Financial Literacy Loan Money

As A Corporate Bobbacon Held Various Prominent Positions In The Top Rated Business Firms And Driven Them To Unpr Akuntansi Keuangan Keuangan Laporan Keuangan

Holographic Wills In Wagoner County Giải Quyết Di Chuc

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Inheritance Tax Explained Rochester Law Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

When You Imagine About A Big City And If You Would Like To Have All Facilities Of Big City You W Rental Property Management Property Management Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Barn Red Brauer Productions Red Barns Parenting Guide Film

Early Morning In Laramie Laramie Wyoming Wyoming Vacation Wyoming

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Estate Tax Everything You Need To Know Smartasset

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)